THE SUNDAY SERIES

(By The Integrity Project)Part 2 — ARPA in Mount Vernon: The First Year of Spending

(2021)Early contracts, early beneficiaries, and early warning signsIn Part 1 of this series, we explained what ARPA was designed to do, what it was not designed to do, and why this unprecedented federal funding mattered so much for a city like Mount Vernon , a city already in deep fiscal distress, with years of missing financial records, failed audits, unresolved deficits, and a near-total absence of internal controls.Now, in Part 2, we turn to the spending itself, but….

- First Things First: What is “Revenue Replacement,” and Why Should We Care?

When COVID hit, cities across the country saw big drops in revenue, everything from parking fees to court fines to building permits. To stabilize government operations, ARPA allowed municipalities two options:

- Calculate their actual COVID-era revenue loss, using a detailed federal formula; or

- Elect a flat $10 million “Standard Allowance” and treat that amount as “revenue replacement.”

Mount Vernon elected the full $10 million Standard Allowance.Revenue Replacement was one of the most important features of ARPA because it dramatically expanded what cities were allowed to spend federal relief funds on. In 2021, non-revenue-replacement ARPA dollars could be used only for a narrow set of purposes, primarily public-health response, economic recovery programs, and specific types of infrastructure like water and sewer projects. But once a city elected the $10 million “Standard

Allowance,” those dollars could be treated as “revenue replacement” and used for almost any traditional government service, including routine equipment, vehicles, technology, staffing, and operations.On paper, that election gave the city broad flexibility, but that flexibility did not mean the funds become unrestricted cash. Under federal law, even revenue replacement money required municipalities to maintain internal controls, document what the money paid for, follow procurement rules, maintain complete accounting records, submit accurate federal reports, and track expenditures within the award period.

And this is where Mount Vernon’s situation becomes uniquely problematic – Mount Vernon entered the COVID era with no reliable infrastructure, financial or otherwise. This context is essential for understanding the concerns that follow.

Where’s the $10 Million?The City’s ARPA project list — which is supposed to represent every project funded with ARPA dollars and which, in total, matches the full amount the City received, includes a single line for a project titled:

Name: Supplementary General Budget; Project ID Code: GOV-004; Adopted Budget: $10,000,000.00; Project Expenditure Category: 6-Revenue Replacement; Sub-Category: 61-Provision of Government Services; Total Obligation: $10,000,000.00; Total Expenditures: $10,000,000.00; Project Description: Standard Allowance’ of loss to be used to replace lost revenue and fund additional and supplemental government services . . . Completion Status: Completed 50 or more.

But in all records reviewed thus far, including the ARPA project spreadsheet, subaward list, individual expenditure files, and transactions over and under $50,000, not one expenditure is coded to GOV-004. Other “GOV” projects include normal entries: vehicles, GIS work, staffing, etc. But GOV-004 appears nowhere except as a single line showing the $10 million as spent.But if the funds supported “government services,” which services? Which departments? Which expenses? So far, nothing reviewed in the FOIL production answers these questions.

If the records do not exist, the most plausible explanation is that the City believed that selecting the Standard Allowance eliminated the need for documentation, that the funds could be reported as spent without tracking how they were used. This is clearly wrong – and until the City provides that documentation, the public is left with an unresolved, critical question:Where is the $10 million?

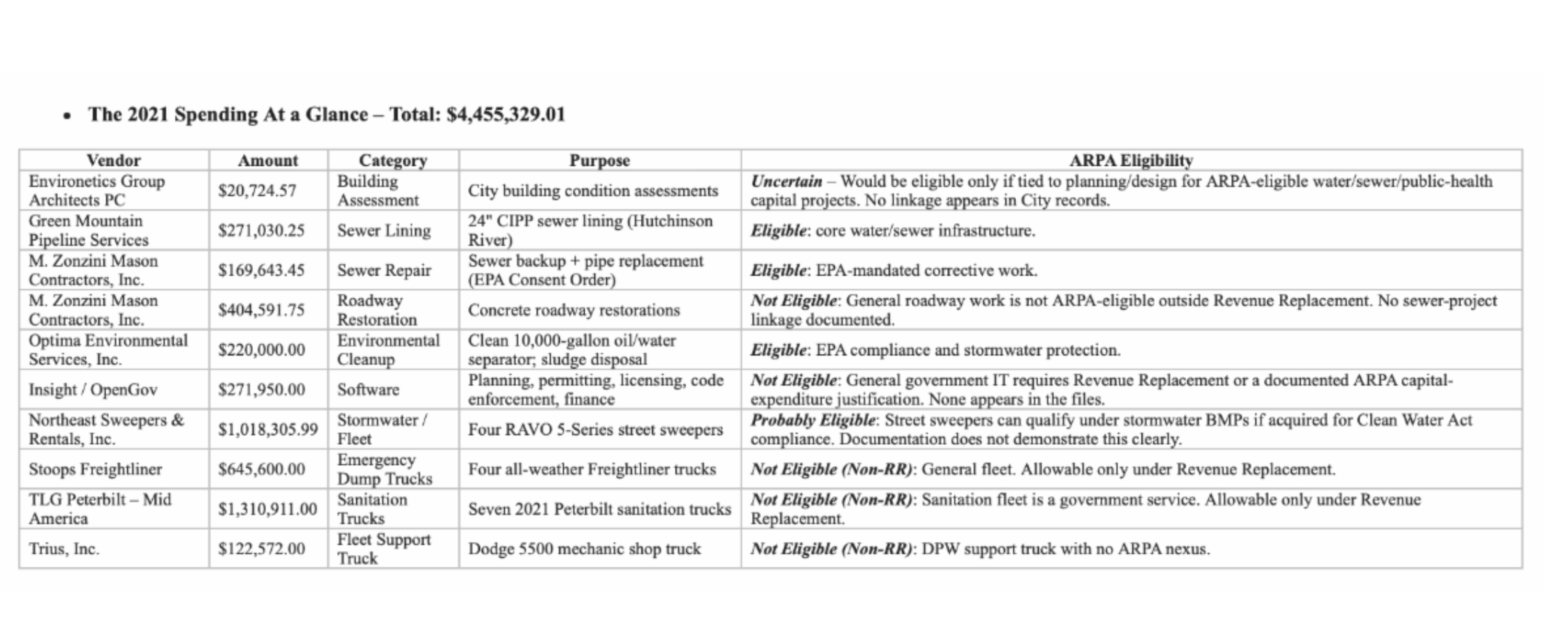

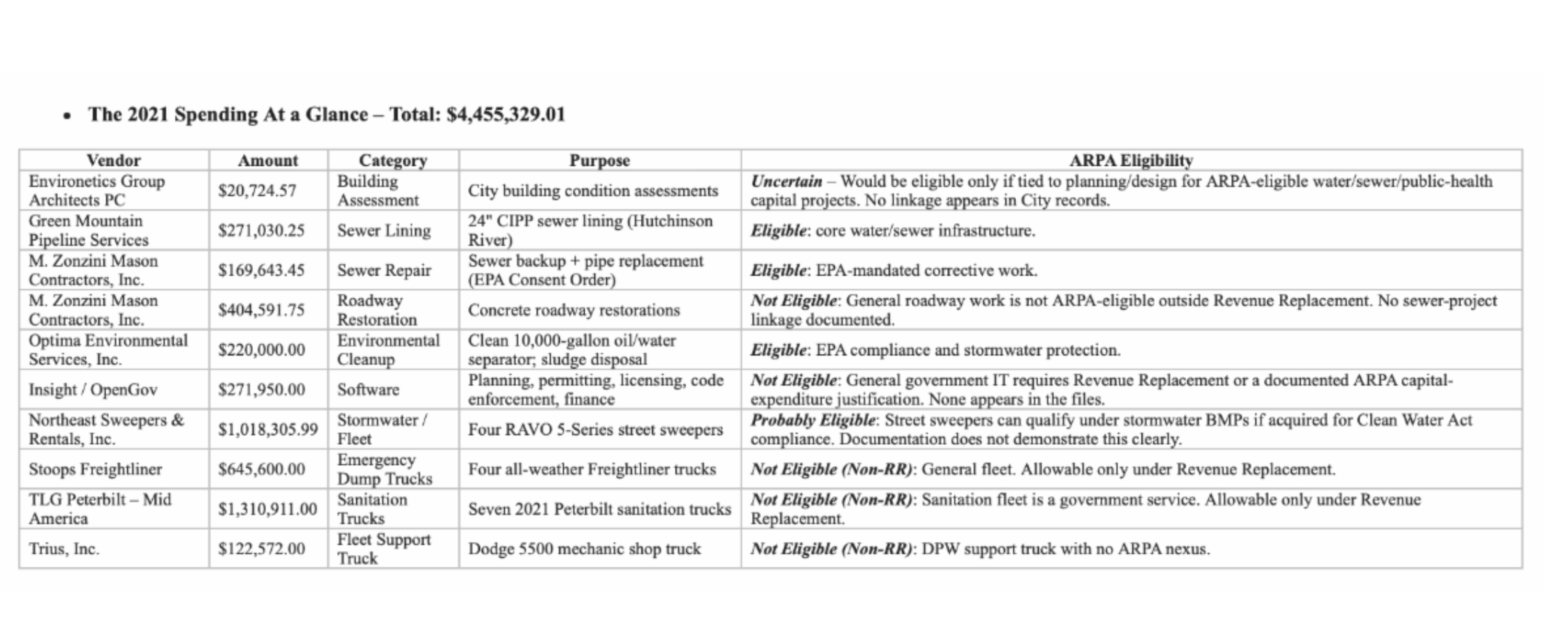

The 2021 Spending OverviewMount Vernon’s documented 2021 ARPA spending falls into five broad categories: (1) sewer and stormwater projects, (2) building safety and engineering assessments, (3) environmental cleanup tied to consent orders, (4) fleet and equipment purchases, and (5) technology modernization.Some expenditures clearly qualify under ARPA’s non-revenue-replacement categories, especially certain water and sewer projects. Others do not qualify, or did not qualify at the time, outside Revenue Replacement, and several expenditures fall into a conditional category: potentially eligible if the City could demonstrate a direct nexus to stormwater compliance or another authorized purpose. The City’s documentation, as produced, either does not make those connections or does so unconvincingly. |

|